The stock market is a lot like life:

- It doesn’t move in a straight line

- You can’t predict the ups and downs

- Your goals and values enrich the experience

When you look at it, life and the markets form many parallels.

For example, when something good happens in life, you want to hold onto that feeling or moment for as long as possible. But when something bad happens, you don’t want to sit in that negative space. Instead, you might take action, trying to change your present situation to something more palatable.

While that could be an effective approach when problem-solving at work, it’s not as clear-cut when dealing with the markets.

Knee-jerk reactions to the market can sometimes do more harm than good to your portfolio’s long-term trajectory, especially for retirees. Making emotional, fear-driven decisions can not only make you feel worse but could have serious long-term financial consequences.

Whether you’re well into retirement, right on the cusp, or it’s just peeking over the horizon, market downturns can be scary. And when riddled with anxiety, it’s easy to act out of fear rather than logic.

Down markets are also inevitable. We subscribe to the “certainty of uncertainty” mindset where we know there will be challenging markets, but the key is how you respond to them.

This idea stems from the Smart Money Philosophy, where we aim to provide you with comprehensive, holistic information so you can make logical, informed decisions. To do that, we help you prepare for uncertainty and encourage you to make financial decisions based on your core values.

Today, we’ll review our best practices for handling market downturns when you’re near or in retirement.

Before we get started, please know that our team at TFS is here to help you navigate any market condition. By keeping your goals and values at the center of your decision-making, we can help you build a plan that lets you live the life you love.

1. Let History Bring Some Context (And Comfort)

Here’s the thing with investing: past performance doesn’t indicate future performance. But that doesn’t mean we can’t learn anything from analyzing historical data.

Let’s go back to the roaring 20s.

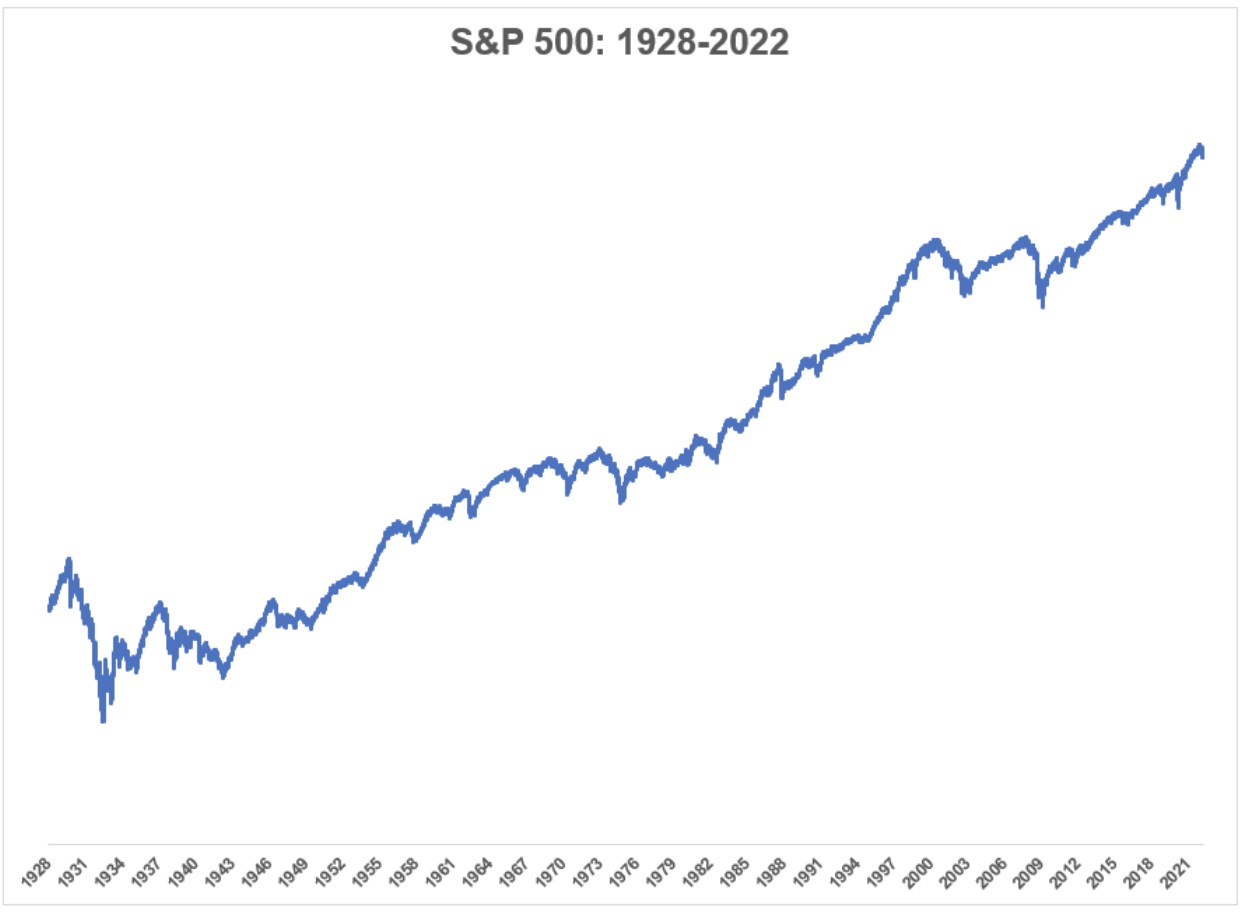

As you can see, the S&P 500 shows a clear, albeit bumpy, upward trajectory over the long term. Data analysts even found that since 1928, the stock market has gone up 9.8% yearly. But remember, that doesn’t mean you’ll see those returns every year; it’s merely an average. We like to say this occurs over time not every time. But nearly a century’s worth of data shows that the stock market does well long-term, even if the road isn’t always paved.

Additionally, the S&P 500 has an 11.88% annualized average return from 1957 through the end of last year. While you might not reap a nearly 10% net return on your investments each year, research indicates that when you zoom out, the markets look far sunnier than you may have expected.

Conversely, the more you zoom in, the bumpier it tends to look. Just follow the daily price on a single stock and you’ll see what that means.

2. Reframe Down Markets As “Stock Sales.”

Who doesn’t love a good bargain?

Finding goods and services on sale feels great and could be a fantastic tool to reframe down markets.

When the markets are down, share prices tend to be more affordable, meaning you could access some companies or funds with previously costly market shares for a value. You may have the opportunity to invest in areas that were once out of reach or purchase additional shares of top-performing companies/institutions.

When you buy instead of sell in a down market, you’re reinvesting more funds at a lower price and setting yourself up to reap the rewards with long-term growth. But be sure you’re not buying simply because of the great price tag. Any investments you add to your portfolio should fit with your risk tolerance, time horizon, and larger financial goals.

Keep in mind if you don’t have cash on the sidelines to invest, you may still receieve some of this benefit when rebalancing your portfolio (more on that below), which many people benefit from reviewing quarterly.

3. Find Alternatives To “Cashing Out.”

Depending on the situation, your current position in the market may not suit your needs. But that doesn’t mean cashing out is the answer.

Instead, you might consider repositioning your funds to better fit your goals. One way to do that is through portfolio rebalancing. Rebalancing allows you to evaluate your current asset allocation and make strategic buying and selling decisions to reach your desired risk levels.

For example, if your portfolio gets too equity-heavy, it may make sense to reposition those holdings into safer, less risky alternatives, and vice versa.

When the markets are out of sorts, it can cause your portfolio to be out of balance with your risk levels, time horizon, goals, and more. Moving assets around can help bring you back to a balanced and aligned position.

It’s important to understand that rebalancing can trigger tax liabilities, so be sure to consult with your financial advisor and tax professional before you start selling off holdings.

There’s also a difference between rebalancing an existing model portfolio and rebuilding the model itself—we can help with both depending on your needs.

Rearranging your assets isn’t “cashing out,” it’s being strategic and true to your larger financial plan.

4. Look For Tax Opportunities

Market downturns can be breeding grounds for tax opportunities. A proactive strategy to consider is tax-loss harvesting.

With tax-loss harvesting, you sell assets that have sustained a loss to offset future gains. You can offset up to $3,000 in capital gains on the current tax code, and if your losses exceed that amount, you can carry it over to the next tax year.

Say you’ve had a fund that hasn’t performed as you anticipated. Now could be an excellent time to sell off that investment and redirect the money to more profitable areas.

Keep in mind that the IRS won’t allow you to claim the loss if you purchase the same or similar asset within 30 days—this is known as the wash-sale rule.

Think about tax-loss harvesting as a way to prune your investments—and remember, pruning is essential to yielding the highest quality fruit.

There’s also an opportunity to capital gains harvest, which means realizing gains in a strategic, tax-friendly way. An example would be maximizing the 0% capital gains tax bracket.

5. Do Nothing (Seriously)

You know when you’re stuck between options and wind up not doing anything at all?

That’s technically still a decision.

And while it might earn you a “procrastination” label in your life, this strategy may just work well for you in terms of approaching your investments in down markets.

Sometimes the best decision is no decision.

If your long-term goals remain the same and your assets are balanced, it might be best to maintain your current course of action.

Not changing anything may be the most difficult decision of all, especially when you see your investments losing money.

6. Reconnect With Your Values

Your values are the guiding principles of your life and your money. Understanding your values gives context and color to your investment decisions. They can help you decide where, how, and why to invest. So before making changes to your strategy, ask yourself,

- What are your core values?

- Have they changed significantly with the market movements? Why or why not?

- How have your values shaped your long-term goals? Have your goals drastically changed due to the current market conditions?

- Would short-term decisions put your long-term goals in jeopardy?

When you return to your values, you force yourself to look at the situation holistically. Remember, fortune smiles kindly on the long-term, so consider if any short-term actions could impact those long-term dreams.

For example, cashing out a significant portion of your investments could put your long-term goals at risk. Doing so could trigger unnecessary taxes and curb net returns as you’d miss out on market rebounds when they inevitably come.

Recommitting to your values also helps you focus on the things you can control. You can’t control the market movements, but you can control how you participate in them.

A long-term lens can help you weather short-term trials.

7. Talk To Your Financial Advisor (AKA, Us)

When you’re in a tough spot, it’s nice to turn to a trusted source for help and guidance. When the markets are down, having a third party in your corner with expertise in this exact situation can be invaluable.

We’ve helped so many retirees gain confidence in their investments, even when times are tough. It’s important to have someone you can count on listening to your concerns and providing tailored solutions that help you reach your long-term goals.

Watching the markets wobble can feel like a high-stakes game of (nest) egg toss—while the markets throw your investments around, you’re sitting on the sidelines, hoping it lands intact without a crack.

Remember, for every investor that feels they have to sell, there’s another investor waiting to buy. Warren Buffet said that “cooler heads prevail,” so try to be that “cooler” head.

We can help you find vision and clarity with your investments, no matter the market condition. Get in touch with our team today. We’d love to answer your questions and offer strategies that allay your concerns.