Just like anyone who was alive could tell you where they were when Kennedy was assassinated, most investors could probably tell you what they were doing when they realized that 2008 was turning into an especially terrible year for the stock market.

We fielded several calls and emails from clients that year who were worried that their investment portfolio would fall apart and ruin their retirement plan. Some insisted on selling, some just wanted to be reassured that we were watching out for them, and others were frozen solid with fear.

Our advice to most people was the same: stick with your plan. Even after talking to them for a while, some people couldn’t understand why they would stick with their stocks after they had taken big hits. They felt like they were going to be destitute in retirement if they didn’t eject from the market now.

That’s an understandable feeling, especially when your life savings is on the line. But we would always tell these clients about the dangers of timing the market.

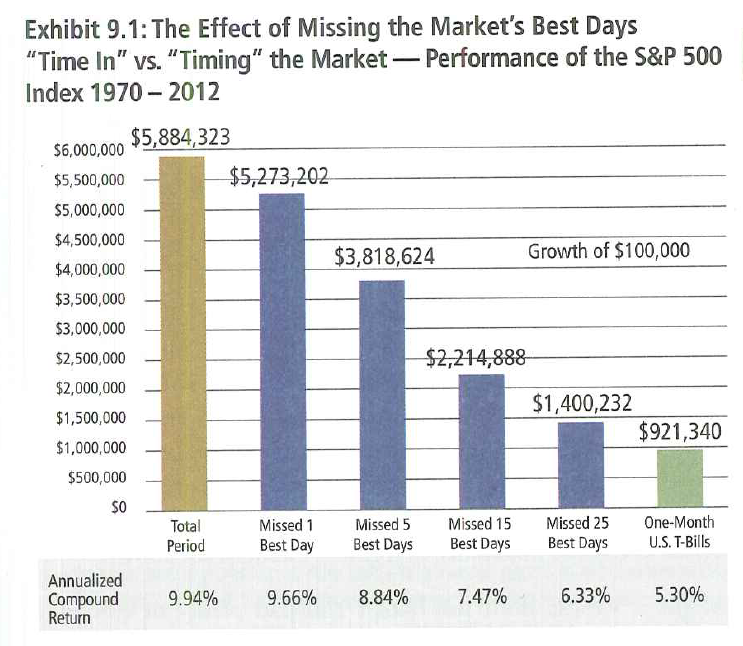

In their book, The Wealth Solution, Steven Atkinson, Joni Clark, and Alex Potts study the effect of missing the market’s best days. They looked at the period from 1970 to 2012 and weighed how $100,000 would have grown had investors stayed in the market the entire time, versus if they had missed the market’s best day from that period, the best five days, fifteen days, and so on.

Source: The S&P data are provided by Standard & Poor’s Index Services Group. US bonds and bills data ® 2012 Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield). Indexes are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. S&P 500® is a registered trademark of Standard & Poor’s Financial Services LLC.

An investor who left their money in the entire time saw their $100,000 turn into just under $5.9 million. If that investor had jumped out of the market and missed the best day, they would have ended up with under $5.3 million. Not that big of a difference, right? Either way, you still have more than $5 million.

But then if they missed the best five days, their total dropped to $3.8 million. At fifteen days that dropped to $2.2 million.

Keep in mind, this is for the entire period from 1970 to 2012. That’s over 10,000 trading days, and we’re talking about missing no more days than you could count on your fingers and toes .

That’s the reason we advised clients in 2008 – and advise clients today – to stay the course. Sure, you’ll hit some bad days, but by not jumping ship when the waters get choppy, you’ll make sure you’re also there for the best days.

And hitting those good days helps your retirement plan stay on track. If you’re hoping for your portfolio to hit $5 million by the time you retire but you get spooked and miss a few of the best days, you could end up a couple million shy of the mark.

That’s why it’s so important to have a plan for when the markets start acting up, because they will act up. Here are four things you can do when the markets are volatile to help keep your retirement plan on track.

1. Stay grounded in your plan.

Often people make knee-jerk reactions to market trouble, and they fail to think about how their spur-of-the-moment decisions will affect their carefully crafted long-term plan. Look back at your plan. You’ll find that a lot of the time, you’re better off leaving your portfolio alone.

If you’re working with a financial advisor, they should have already stress-tested your plan to make sure it’s safe from volatility. We test our plans against multiple scenarios, including the market dropping 35 percent.

2. Keep a level head.

We know the danger of missing the best days in the market, but many people still think they can avoid the bad days and get back in time to get the good days. The problem with this approach is that no one knows when the good and bad days will show up, and the truth is that the best days are often not far behind the worst ones.

For instance, the market dropped 25% in one day in October of 1987, but the best trading day of the year came just a week later. We have talked to people who proudly proclaim that they went to all cash before the recession of 2008 so they didn’t lose anything, but they’re still sitting in cash so they’ve missed out on all the growth since then.

Sure, it’s great to miss the bad days, but if you never get the good days, is it really worth it?

When a pilot is flying through storm clouds, they can’t see which way to go. They have to look back at their tools. It’s the same when you’re investing. When visibility gets murky and it seems like everything is going badly, look back at your plan to help you remain grounded.

3. See if and where you should make adjustments.

Earlier, I talked about how our advice to our clients in 2008 was to stay the course. While that’s true, we did make some minor adjustments. For instance, we turned off the automatic rebalancing that would have had people buy more stocks at that time. Looking back, maybe it would have been better to leave that on, but psychologically speaking, that small tweak allowed many of our clients to stay with their plans.

Another place where we see that adjustments can be made when things get tough is with your goals. When we initially set up a retirement plan for you, we segment your goals into three areas:

- Needs – Medical expenses, mortgage payments, etc.

- Wants – Leave a legacy for your children

- Wishes – Leave a large legacy for your children

If the markets act up and your ability to keep up with paying for medical care and making mortgage payments is threatened, then we can pull back on some of the wants and wishes to ensure the needs are still taken care of.

4. Consult with your advisor.

We get a lot of calls when the markets start acting up, and it’s completely understandable. Often people have their life savings – their retirement, their kids’ college tuition, their house – on the line. Most of the time, we advise people to wait out the storm.

The truth is, having an advisor doesn’t guarantee superior returns. But we try to put you in a position with high probability of success. Does that mean it’s always going to work? No, but it increases the likelihood.

A lot of times, having an advisor you can use as a sounding board is key. Not many people will tell their friends they lost $200k this year. Most family members don’t even know how much money you have. The only person you can tell that to and talk to about it is someone who already knows how much money you have.

So next time the markets act up and you start worrying about your retirement plan, consider these four courses of action before making any decisions.

Don’t have an advisor you can consult with when things go south? We’d love to talk.