In 2022, our Vice President Aaron Terwedo joined CEO Dale Terwedo in earning his Chartered Financial Consultant® (ChFC®) designation.

While you may have heard the acronym before, not all investors are familiar with the actual benefits of having a ChFC® professional in their financial lives.

Below is a quick breakdown of the ChFC® designation, how it differs from other common designations, and, most importantly, how it will benefit your experience working with TFS Advisors.

What Is The Chartered Financial Consultant® Designation?

A Chartered Financial Consultant® is a professional designation for those who complete a comprehensive financial curriculum.

To be considered for participation in the ChFC® program, the applicant must have at least three years of experience working full-time in the financial industry.

The curriculum includes eight college-level courses in which students must achieve mastery of more than 100 advanced financial planning topics, such as

- Retirement Planning

- Estate Planning

- Insurance Planning

- Income Tax Planning

- Financial Planning Process

- Asset Protection Planning

- Employee Benefits Planning (like Healthcare)

- Estate & Gift Tax Planning

In addition to these topics, the program focuses on the practical (real-life) application of financial planning responsibilities. This gives the student who completes the program advanced financial planning skills to address every person and their needs more effectively.

TFS Advisors Vice President, Aaron Terwedo, had this to say about his experience taking the course:

“It is one thing to read about it, but this program gives you real-life examples your clients will experience throughout life. One of the sections I enjoyed was the special needs and tax planning sections.”

What Can a ChFC® Do For Investors?

Working with a ChFC® allows you to collaborate with a professional who can comprehensively address your financial planning needs. Their expertise in investment planning, income planning, tax planning, risk management, and estate planning can help you develop a comprehensive financial life plan that suits your personal and financial goals.

Their focus is on approaching financial planning holistically. In addition, they are fiduciary advisors, meaning they have to act in your best interest—holistic financial planning centers around looking at your financial plan in context. Rather than saying, “I need my investments to make a certain amount over time,” it would also consider how those decisions may impact your tax bill, future goals, risk management, etc.

By looking at your financial situation from every angle, you can ensure harmony between the moving parts of your financial life.

At TFS, we can help you coordinate your tax plan with your CPA (Certified Public Accountant) and legacy planning goals with your estate planning attorney. We’ll even go as far as helping you negotiate your utility bills or get the best price on a car. Holistic planning thrives when all of these pieces are interconnected.

We’re passionate about helping you connect your goals with your values. Doing so puts you in a position to achieve what’s most essential and bring fulfillment to your life. This strategy enables you to look at money as a tool, not a goal, helping you achieve your personal and financial ambitions.

If financial planning is a football team, your financial advisor is your quarterback. Like how a quarterback leads their team, your advisor can be the champion of your money by ensuring everything is in order and in a position to make the best long-term plays.

What’s the Difference Between ChFC® vs. CFP®?

You’ve likely heard the term CERTIFIED FINANCIAL PLANNER™ (CFP®). So, what’s the difference between a CFP® and a ChFC®?

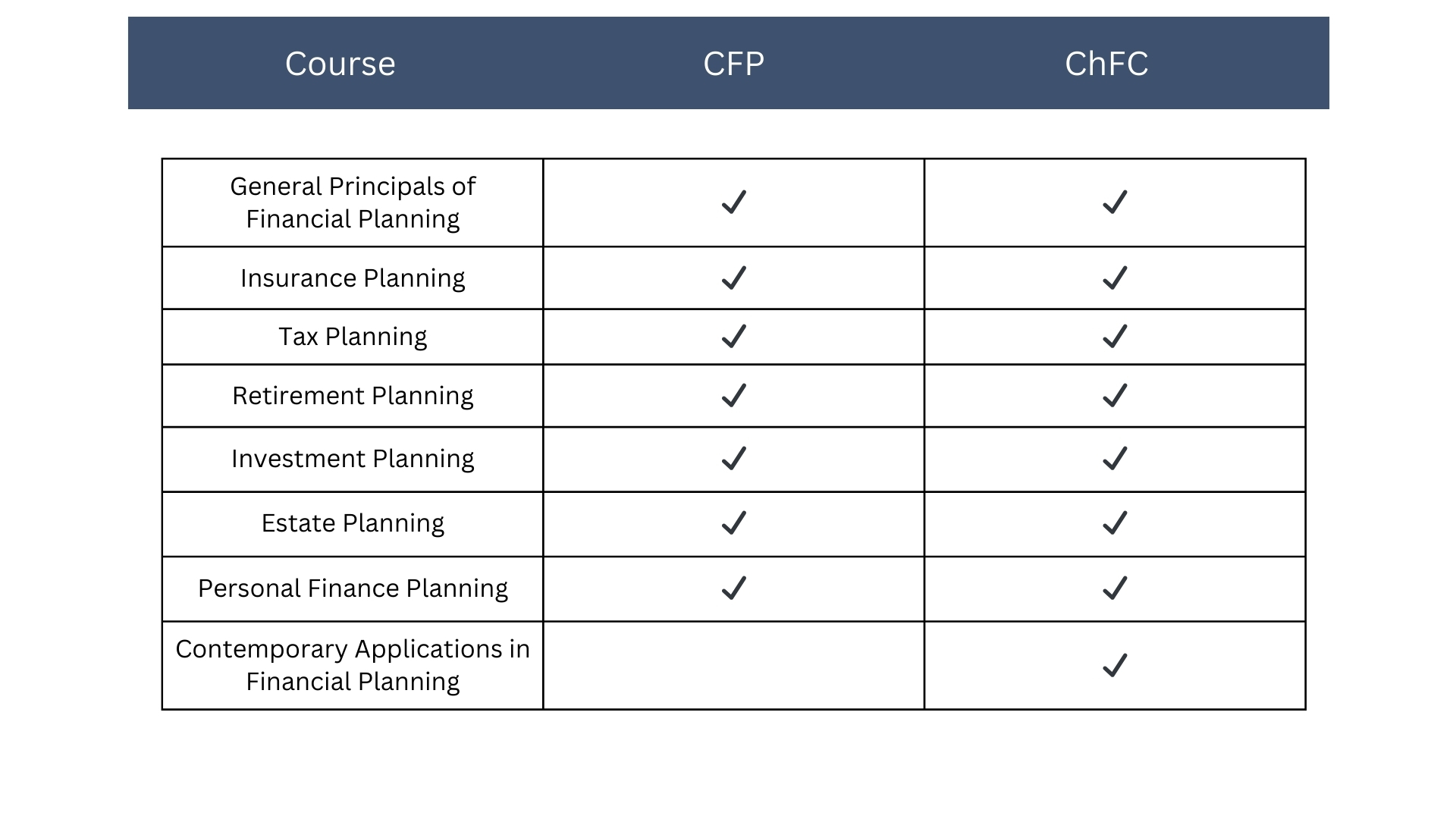

Each certification requires a different amount and type of training. The chart below breaks down the distinct training areas for each designation.

ChFC: What Is A Chartered Financial Consultant? – Forbes Advisor

Both designations are held to a fiduciary standard, which is a legal requirement to consider their client’s best interests when making decisions.

In addition, both designations must pursue ongoing educational and professional development. Every two years, both ChFC®s and CFP®s must obtain 30 hours of continuing education, including an ethics course.

The good news is that at TFS Advisors, both of our partners and financial advisors, Dale and Aaron Terwedo, are ChFC® professionals. With their combined expertise, we can be your financial dream team.

Continuing Our Commitment to Excellence

For those who already work with us, you know that our team and services embody the core tenets of what the ChFC® designation teaches. Because we have several ChFC® professionals on our team, we can formally establish the duties of a ChFC® and integrate them into our client relationship process.

At TFS, we understand the importance of holistic financial planning, which is why we do it! We want you to feel comfortable with your financial plan and know that it’s embedded into all aspects of your life journey.

If you need financial guidance, schedule a meeting with our team today. We look forward to the opportunity to create a customized, practical plan that you can carry with you throughout all seasons of life.