It’s easy to recognize when you’re paying too much at a store or restaurant. If the menu says $5 for a burger and the check comes out to $12, anyone can see that a mistake has been made.

But what about other, less obvious areas? For instance, what’s the annual fee on your credit card? These small monthly fees are hard to notice unless you’re looking for them, but they can add up to a lot of money over the long run.

Some people look at advisor fees the same way, almost as though they’re always watching out for someone to “pull one over” on them. It’s understandable. It’s hard to know how much is appropriate to be paying since the term “financial advisor” can encompass a lot of different services.

Investment managers often charge fees as a percentage of total assets, which is typically shown in quarterly performance reports. For example, if you have a $1 million portfolio that’s managed by an advisor charging one percent per year, you will pay $10,000 per year, or $833 per month, for investment management services.

Whether or not that sounds reasonable depends on you and the level of services your financial advisor is providing. Some people might balk at paying that much, while others may understand the level of value they are getting in return for the fee.

Financial Advisors Aren’t All the Same

As an advisor, I can confidently say that the financial services industry isn’t exactly known for its simplicity. With terms like 401(k), 403(b), and SEP IRA, you might be overwhelmed by the number of account options, investment options for those accounts, and tax implications associated with planning for retirement and other estate needs.

That’s one of the reasons financial advisors exist: to help simplify these choices. But sometimes their own fee structures and affiliations can be just as complicated for clients to understand. Then we also have the complexity brought on by the regulatory environment itself. (Believe me, if we could simplify things sometimes, we would!)

To understand the differences in advisor fees, we have to remember the different types of advisors.

Most financial advisors fall into two categories:

- Investment managers will help you determine how much to invest and pick the right mix of stocks, bonds, and other assets given your age and goals. For example, they might look at your age, determine you need 60 percent equities and 40 percent bonds, and then purchase a group of mutual funds meeting those criteria.

- Financial planners take a more holistic view and help you with everything from building a household budget to estate planning considerations. For example, they might determine that your traditional IRAs are best converted into a Roth IRA during a certain year to take advantage of your current tax bracket and help you invest that money.

Regardless of which type of advisor you work with, they typically collect fees in one of two ways:

- Fee-based advisors charge a flat fee each month, quarter, or year for financial advice, and/or a percentage fee on the assets under management. They often don’t receive much or any commission from mutual funds they recommend. This means their advice is usually independent and free of conflicts of interest. This is how we operate at TFS.

- Commission-based advisors don’t charge any flat fee for financial advice, but they receive a commission from the mutual funds that they recommend. At TFS, we prefer a fee-based approach because we think it leaves less room for conflict of interest, but I’ve met plenty of commission-based advisors in my day who were fully committed to their clients, not just their bottom line.

Advisors are paid in several different ways, so it’s important to figure out how an advisor’s fees work before signing on with anyone.

Are You Overpaying for Financial Advice?

To a large extent, the amount you pay for financial advice depends on what level of service you’re getting in return, and that depends on what you want to get out of the relationship.

At TFS Advisors, we begin with a complementary introductory consultation that involves determining if your needs match our philosophy and practice. We want to add value, but we also want to make sure that together we can build a productive collaborative relationship.

We then gather detailed information about your financial situation and learn about your goals and aspirations for yourself and your family. After analyzing this information, we develop a financial plan to meet your specific goals, implement the necessary accounts and transfers, and monitor the plan to address any changes.

So What Does a “Reasonable” Fee Look Like?

Most advisors handling less than $1 million charge between 1 and 2 percent of assets, which is generally what you can expect to pay for full-service, holistic financial advice from a small or mid-sized firm that can give you the attention you want.

“Why Would I Pay an Advisor When I Could Just Invest the Money I Would Spend on Their Fees?”

We get this question a lot, and I understand where it comes from. After all, wouldn’t that 2 percent annual fee do more for you if you invested it?

A few years back, Vanguard did a study where they talked about something called “Advisor Alpha.” Basically, they looked at the value of an advisor’s knowledge and compared that with the cost of reactive decision-making on the part of investors.

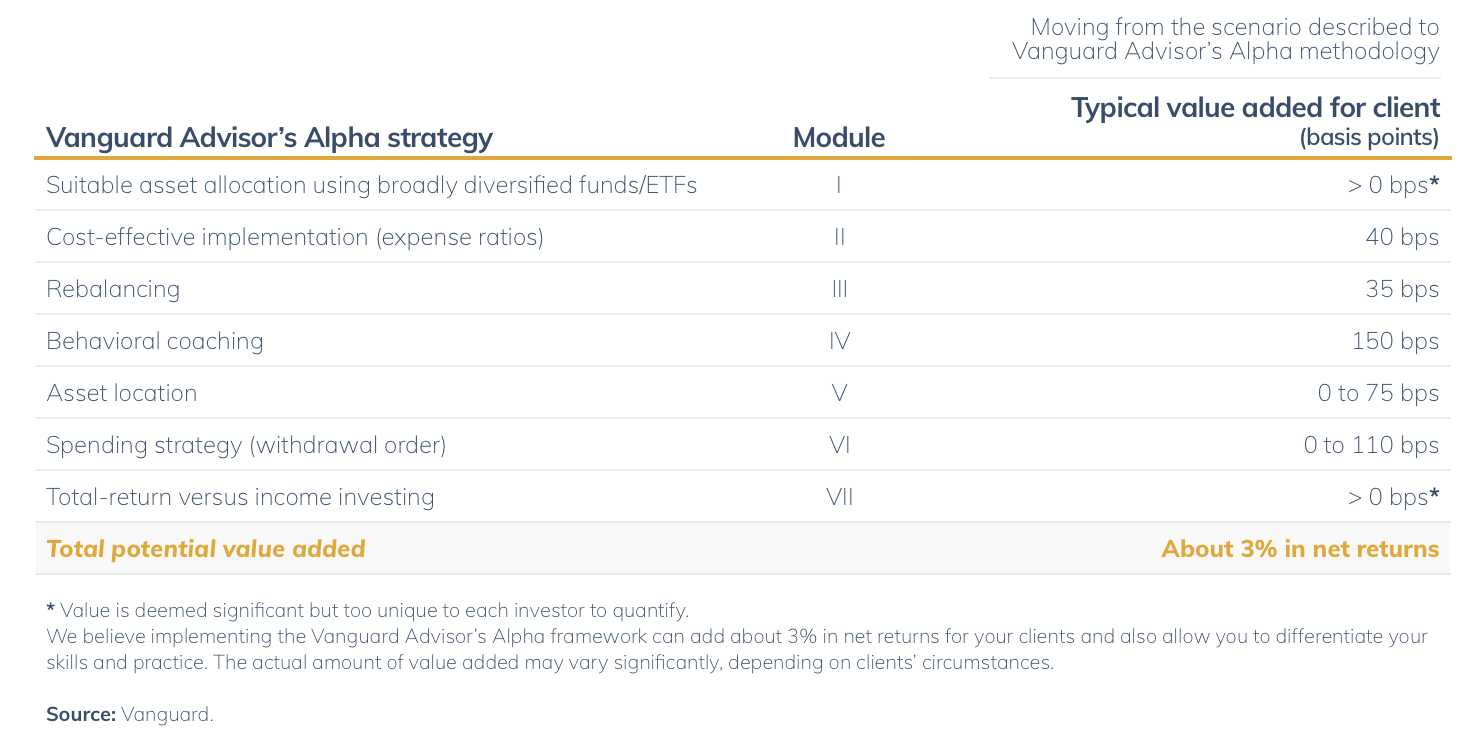

Vanguard estimated that – without considering market returns – the typical advisor’s knowledge can add roughly 3 percent net returns for clients. That 3 percent comes through their experience, portfolio rebalancing, keeping clients focused on strategic decisions, and other services they provide (see Table 1).

Table 1: Advisor Alpha

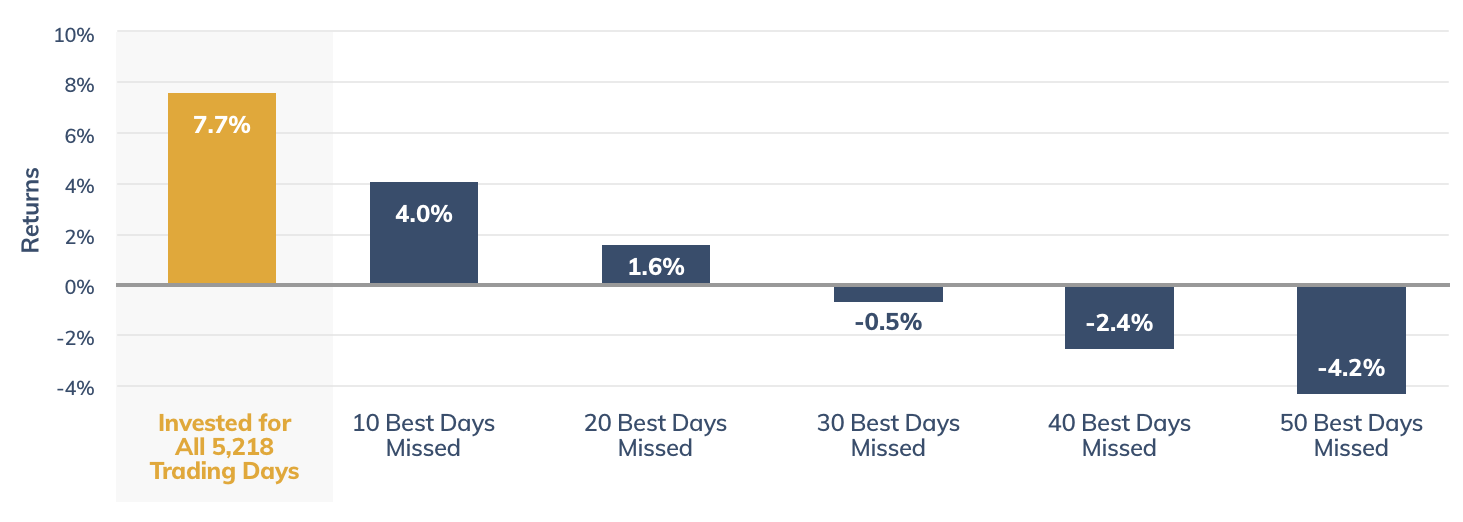

The “behavioral coaching” mentioned above comes in the form of helping you think through big, possibly emotional decisions, like pulling all your money out of the market when it has a bad day. As you can see below, while the above table puts the value of behavioral coaching at 1.5 percent, not having someone to help keep you on track can cost you much more.

Minus the typical advisor’s fee of 1 to 2 percent, clients are looking at an Advisor Alpha of 1 to 2 percent.

How to Avoid Overpaying for Advice

You might want to consider automated financial planning with a robo-advisor or using simple low-cost target date retirement funds if you’re just starting out and have less than $500,000 in assets. If you need specific advice at this stage, consider hiring a fee-based financial advisor by the job. Rates vary widely, but you can expect to pay an hourly rate similar to an attorney or other professional to answer pressing questions on-demand, rather than paying to have someone on retainer.

When your assets start growing – say, around $500,000 or so – you may want to consider looking into hiring a full-service financial advisor. There are a lot more variables at this stage, and, according to Vanguard’s Advisor Alpha study, the added cost of advice often pays for itself when deciding between the right accounts to minimize tax exposure or ensuring that you’re in the right funds. After all, a one percent savings on a $100,000 portfolio is just $1,000, but it’s ten times as much for a $1 million portfolio.

Want to compare the fees you’re paying to what you could get with TFS? We’re happy to do a fee comparison for you, just drop us a line.