Life is full of milestones.

At 16, you get your driver’s license. At 18, you vote for the first time. At 21, you can buy your first glass of wine. At 40, you are officially “over the hill.”

Then it’s time to start thinking about big health questions: at 45, women should start having regular mammograms. At 50, colonoscopies get added to the schedule.

But what about those other milestones? You know, the ones that help you maintain your financial health?

Most people have several milestones in mind when it comes to retirement planning – their ideal retirement date, the dates Medicare and Social Security kick in, when they have to take minimum required distributions from their retirement accounts, and so on.

Each of these milestones involves important decisions that can have long-term implications, so you’ll want to add them to your calendar.

50: Catch-up Contributions

The average retirement savings for working-age families – defined as those between the ages of 32 and 61 – is about $95,776, according to the Economic Policy Institute. While that may seem like a healthy amount, the median retirement savings for working-age families is just $5,000, which suggests that there is a large disparity between retirees. Families between 50 and 55 have an average savings of $124,831, but the median is a mere $8,000.

In fact, as of January 2018, 41 percent of baby boomers say they have nothing saved for retirement.

Of course, the Internal Revenue Service provides a way to catch up on contributions. Individuals can make annual catch-up contributions of up to $6,000 on 401(k), 403(b), SARSEP, and governmental 457(b) plans. These catch up contributions can be a lifesaver if you are able to max-out your contributions but began saving later in life and don’t have as much as you’d like. Some people find it easiest to start off small and then increase their contribution percentage each year until they reach the maximum contribution of $6,000.

Consider adding a calendar reminder a few months before you turn 50 to revisit this issue and decide whether you should consider making catch-up contributions. This is also a good time to revisit other areas of retirement planning, such as planned retirement expenses, to make sure that everything remains on track.

59 ½ to 62: Early Retirement

Retirement is an important life milestone. While most people want to retire as soon as possible, they may not fully understand the implications – financial, physical, and mental – of their actions. Making poor decisions at this stage can be extremely costly in the long run, to your wealth and health.

Maybe you want to retire early. That’s an expensive proposition, but it makes sense for some people. Maybe you want to keep working into retirement, that makes good fiscal sense, but what will it mean for your quality of life?

Free Checklist: Birthdays to Put on Your Financial Calendar

You normally can’t start making withdrawals from most retirement plans until you hit 59½ (at least not without incurring the 10 percent early withdrawal penalty), although there are always exceptions, such as unreimbursed medical expenses, higher education expenses, or disabilities. Additional exceptions can be found in Rule 72(t) from the IRS.

It can get pretty complicated, so before you start making withdrawals, take some time to talk it over with a professional.

Also at 59½, some 401(k) plans allow you to roll over your funds into an IRA while still remaining an active participant in the plan. This can be advantageous in some cases when you want more investment options than your 401(k) provides.

Age 62 is the earliest you can claim Social Security for most people, but you can’t get full benefits until 66 or 67. Even then, you’ll want to make sure you’ve considered your options first as the longer you wait, the bigger the benefit. You can delay until you turn 70.

Most of all, we would encourage you to enlist the help of a professional when making your Social Security decision. Of course we would love to work with you, but whoever you decide to work with to plan for your retirement, you’ll want to make sure to discuss how to maximize Social Security to meet your needs.

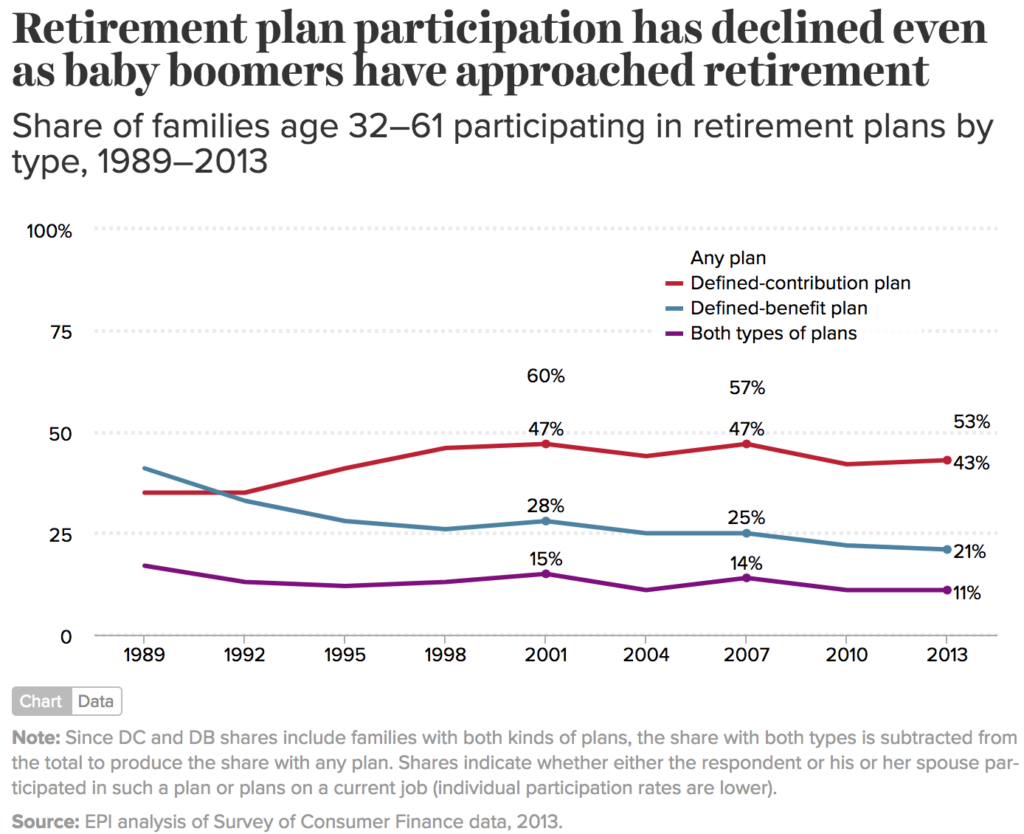

Of course, Social Security is a large factor in many people’s retirement plans, just make sure it’s not the only factor. Since pension plans (defined benefit) are mostly a thing of the past, it is extremely important to develop other retirement funds (defined contribution) if you want resources greater than just Social Security in retirement.

Consider adding a calendar reminder a few months before age 59 ½ and 62 if you’re considering an early retirement. At that stage, you can re-run the numbers based on your existing retirement assets and see what makes the most sense. You can also reassess your wider retirement strategy and ensure that everything is on track, including any catch-up contributions that might help you reach an ideal retirement goal.

65 to 70: Social Security & Medicare

Some people choose to retire between the ages of 65 and 67 to maximize their benefits. Three months before turning 65, you can sign up for Medicare coverage to offset the cost of healthcare, and coverage begins as early as the month you turn 65. If you don’t sign up on time, your Medicare Part B and D premiums could permanently increase, and you could be denied supplemental coverage – a big mistake!

In addition to Medicare, most individuals can start claiming full Social Security benefits between the ages of 66 and 67, depending on their birth year. Individuals that are working and collecting Social Security can also do so without any earnings limit. As I said above, if you can wait to claim until you’re 70, you will get a higher monthly benefit. However, this needs to be looked at through the lens of both financial and health issues.

Consider adding a calendar reminder six months before turning 65 to prepare to apply for Medicare benefits, as well as a reminder at your Social Security age to consider taking or delaying benefits.

Missing these deadlines can be extremely costly over the long term, while delaying Social Security benefits can be very advantageous in some cases. This makes these dates among the most important for those about to retire.

70½: RMDs & Legacy Planning

Generally, many retirement accounts have a required minimum distribution (RMD) that begins at 70½ years of age. For example, traditional IRAs require account holders to begin taking distributions the year you reach 70½. If you fail to take your RMDs every year starting at 70½, the IRS will penalize you to the tune of 50 percent of your distribution.

Even if you don’t need your RMD to supplement your income, you still have to take it out. What you do with it is up to you – you can even put it right back into investments, or donate it to charity, thus avoiding the taxes on it – the IRS just wants to make sure they get their cut, which they can’t do until you withdraw it.

At the same time, it might make sense to convert some traditional IRA or 401(k) assets into a Roth IRA or take other actions to minimize tax exposure and maximize the amount that will be left to your heirs. This is a conversation you’ll want to have with your advisor as well as your CPA, as such conversions are considered a taxable event, so you’ll want to make sure it makes sense in the bigger picture. Of course, there are countless other estate planning issues that may be important at this age.

Consider adding a calendar reminder a few months before turning 70½ to revisit your retirement situation and determine if any changes are needed. For example, it might make sense to shift some assets around to minimize tax exposure and maximize the money that’s left to your heirs. These decisions can become very complex, so it often makes sense to work with a financial advisor and/or estate lawyer to ensure everything is in order.

Importance of Planning

There are many important milestones for those approaching and already in retirement. In many cases, missing sign up deadlines or making haphazard decisions can be extremely costly over the long run. Consider adding these key dates to your financial calendar to avoid any costly mistakes and maximize your retirement benefits.

Free Checklist: Birthdays to Put on Your Financial Calendar

At TFS Advisors, we specialize in helping you prepare for important life events and can help you think through any of the above milestones. For more information, contact us today for a free consultation.