Have you felt a shift in the air? Been sensing a change in the world of investment strategies? We haven’t reached the end of summer, so it shouldn’t be a cool fall breeze (not yet, at least!). Rather, you’ve likely noticed the U.S.’s lean from Mutual Funds to Exchange Traded Funds (ETFs).

If the terms mutual fund or ETF sound foreign, don’t sweat! That’s why we’re excited to share this webinar with you. This team of financial experts will explain the following:

- The basics of mutual funds and ETFs, including what they are and how they work

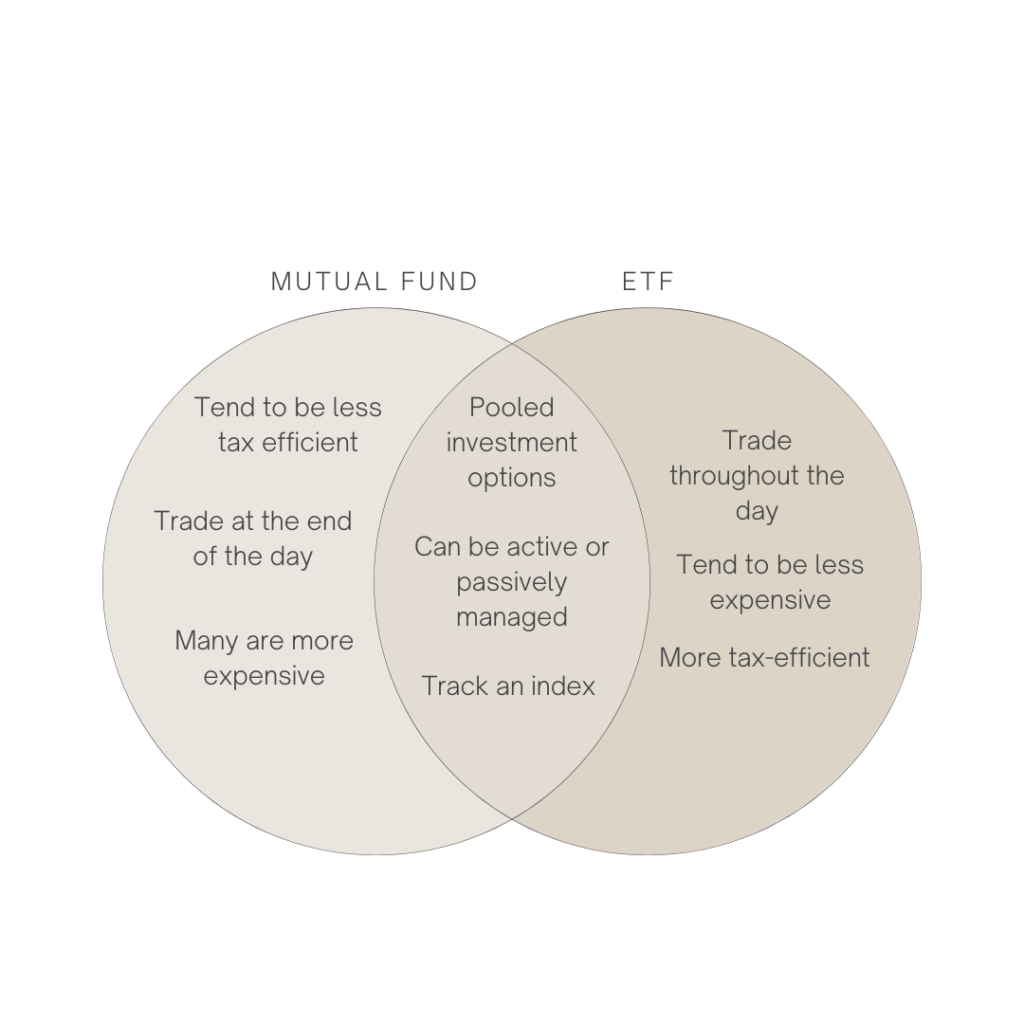

- The similarities and differences of each vehicle

- How each benefit investors in different ways.

Excited yet?

Let’s dive in!

These Investments Help Your Portfolio Work Smarter, Not Harder

If you’ve spent time researching or discussing investment strategies, you’ve likely come across the term “mutual fund.” For those unfamiliar, a mutual fund is a way to “pool” shareholders’ assets. Kind of like how you and your friends might combine funds for an upgraded Airbnb on vacation.

What’s the benefit of this strategy? There are actually a few! Mutual funds can offer shareholders greater diversification (by allowing for a much larger pool of investments than most investors can manage on their own), the opportunity to have their investments professionally managed, and the ability to buy into more expensive investments.

But mutual funds aren’t the only way to get these investment benefits anymore; there’s another investment in town—ETFs. This investment operates similarly to a mutual fund as they both offer shareholders diversification benefits and broader access to different securities.

However, they differ in the way they are managed and traded.

Why Do I Need to Know About Mutual Funds And ETFs?

The bottom line is that mutual funds and ETFs are popular (and powerful)!

At the end of 2021, there were over 8,000 active mutual funds with around 27 trillion dollars in assets. At the same time, there were approximately 2,600 active ETFs with about 7 trillion dollars in assets. That’s a considerable amount of assets between the two of them!

The webinar takes a deep dive into mutual funds and ETFs. If you want a sneak peek, we’ve created this graphic to give you a glimpse at the big picture for each vehicle.

Let The Learning Begin

Ready to nerd out on investments with us?

There’s a lot of evidence supporting a shift in the finance industry toward adopting and utilizing ETFs, so we brought in an expert to talk about it. We’re so happy to have Jeff Cornell from Avantis Investors lead you through the nuances of each investment type. At the end of the session, you should:

- Understand how mutual funds and ETFs work

- Know the potential benefits and limitations of mutual funds and ETFs

- Have a sense of the tax treatments and portfolio impacts of mutual funds and ETFs

While this might not be the most glamorous finance webinar you’ve ever been a part of, it’s vital, foundational information that can help your portfolio work more effectively!

Before you tune into the webinar, please know that you will need to input your name and email address to view it.

Also, If you’re a Seattle Seahawks fan, you’ll love the football banter at the beginning of the video—make sure not to skip it!If you have any questions about mutual funds, ETFs, or any investment-related questions, we’d be happy to help! Set up a call with us today to discuss an investment strategy that works for your financial and personal goals.