There are several reasons to watch the Super Bowl—competition, the love of the game, the halftime show, and for some, most importantly, the commercials. Superbowl commercials have developed a reputation for bold storytelling and unforgettable ad campaigns.

Rocket Mortgage’s “be certain, not pretty sure” is one for the books. The ad features starry-eyed home buyers contemplating whether or not they can afford their dream house. After saying they were “pretty sure,” comedian Tracy Morgan highlighted the dangers (in an exaggerated Jumanji-style manner) of being “pretty sure” in difficult situations like sky diving, eating wild mushrooms, encountering murder hornets, challenging a pro wrestler, and more; all in hopes of highlighting that certainty should win the day, especially when purchasing a home.

Today, we’d like to mirror this sentiment (without the life or death risks) when it comes to calculating your Social Security benefit. Even if on shaky legs, Social Security is still estimated to replace about 40% of your income in retirement.

Knowing your benefit, even an estimate, can help you start to put some pieces of your retirement plan together like more accurately building an income plan, constructing a budget, considering your taxes, and more.

How can you calculate your Social Security benefit, and will it bring more certainty into your retirement plan? Let’s find out.

Funding Social Security

Social Security is primarily funded through a dedicated payroll tax—you know, the 12.4% you split with your employer each pay period.

In 2021, you pay 6.2% tax on all wages up to $142,800. If you’re self-employed, you’re responsible for the full 12.4% up to the same income threshold. Never fear; you can deduct half of the Social Security tax on your annual return.

Increasing the payroll tax, taxing other forms of income, and even upping the payroll tax cap are all ideas researchers, committee members, SSA employees, and lawmakers are considering in their efforts to shore up the Social Security trust.

How your benefits are calculated

Contrary to popular belief, your Social Security benefit doesn’t rely on how much you contribute. Current contributions support present-day beneficiaries, so what you put in isn’t directly tied to how much you take out.

Calculating your benefit is a mix of understanding the Social Security Administration’s (SSA) formula and deciding when to enroll.

- The SSA assesses your average index monthly earnings over 35 of your highest-income years (try saying that five times fast).

- They apply a formula to that number to get your primary insurance amount (PIA) or the amount you would receive should you start benefits at your full retirement age (67 for those born in 1960 or later). This formula factors-in your earnings, years in the workforce, and inflation.

- Your benefit is also impacted by when you enroll in the program. Enrolling early, at 62, permanently reduces your benefit by up to 30%. Delaying retirement, even just a year or two after reaching full retirement age, increases your benefits by accruing delayed retirement credits.

The simplest way to calculate your benefit is by creating a “my Social Security account” and downloading your earnings statement.

If you want to know how the process works behind the curtain, keep reading.

Five steps to calculate your Social Security benefits

While you can pop over to a Social Security calculator, unless you’re super close to retirement, it only serves as a ballpark estimate. There’s a better (in-depth) way to get a more accurate picture of your benefits. Below are the steps.

- Adjust all your earnings for inflation

- Pick out the 35 highest inflation-adjusted years

- Calculate your Average Index Monthly Earnings (AIME)

- Discover your Primary Insurance Amount (PIA)

- Adjust based on claiming age

Five simple sentences, full of complex processes. It’s time to take a closer look at each of these steps.

Step 1: Adjust earnings for inflation

The SSA uses the national average wage index to calculate retirement benefits. This metric adjusts your earnings to account for inflation in the years prior to retirement. Your earnings are indexed to reflect the average wage level two years before your date of Social Security eligibility.

If your eyes glazed over, don’t worry! We’ll simplify this for you. If you’re eligible for benefits at 62, your wages will be indexed to the average wages in the year you turn 60. For those retiring in 2021, for example, the SSA would use the average wage from 2019, which was just about $54,100.

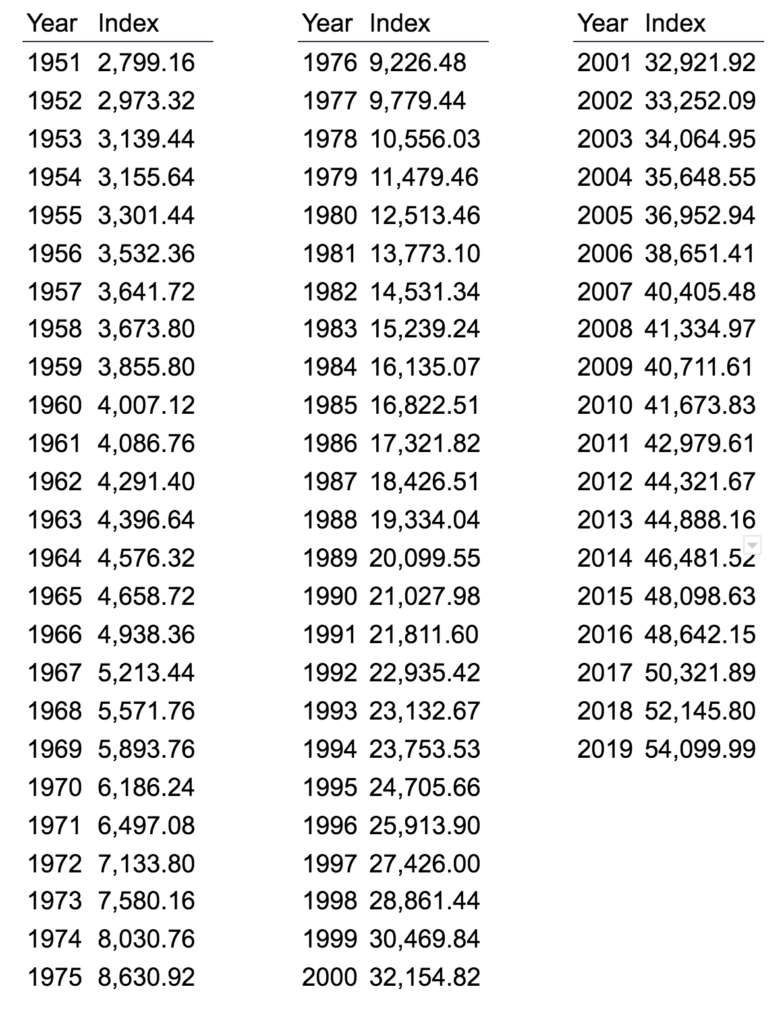

That number is then multiplied by the wage ratio of each year prior to determine a wage for every year worked. The SSA keeps a record based on the National Average Wage Indexing Series found below.

National average wage indexing series, 1951-2019

Step 2: Find 35 highest inflation-adjusted years.

You can perform this calculation the old-fashioned way or pop the year you plan to retire into the SSA calculator. This will give you indexing factors going back to your birthday.

Your benefit is partially based on your 35 highest income-earning years. If you have less than 35 years of work history, a “0” is imputed in the formula, decreasing your overall benefit. That’s why it’s often better to work a couple of extra years to get the biggest benefit possible.

Step 3: Calculate your AIME

Once you’ve compiled your 35 inflation-adjusted years of earnings, you’ll divide that number by 420—the total number of months in 35 years. This gives you a monthly inflation-adjusted number.

Keep in mind that for those retiring in 2021 (and collecting benefits), the SSA wouldn’t index any earnings after 2019. Should those two years represent your highest earnings, that number would be factored into your total before dividing it by 420.

Step 4: Discover your PIA

You also need to factor in bend-points when calculating your benefit. These points are based on three separate percentages of your average indexed monthly earnings (what you calculated above). These bend points are set by law and in 2021 are:

- 90% of the first $996 of your AIME

- Plus 32% of your average earnings between $966 and $6,002

- Plus 15% of your average earnings over $6,002

There is a maximum benefit set each year, and for someone filing at 70 in 2021, that maximum is $3,895. Someone at full retirement age would be capped at $3,148. By filing as early as 62, your benefit would reduce to $2,203. Remember, this is a general example, and your monthly benefit can be calculated by following the above process.

Step 5: Adjust based on your age

As we’ve discussed throughout this article, the age you claim Social Security benefits greatly impacts your monthly check. Collecting early, at 62, reduces your benefit by about 30%. Waiting until full retirement age is a great option, as it guarantees your full PIA. Delaying benefits can boost your monthly check, and is something to seriously consider. You accrue delayed retirement credits until 70, at which point you receive the maximum benefit.

SSA tools and resources for calculating your benefit

Social Security can be a complex system, especially when it comes to calculating your benefits. If you’re feeling overwhelmed by this process, start by making use of the wealth of resources on the social security website. There, you’ll find several calculators, some more comprehensive than others, to help give you a better understanding of your future benefits.

- Retirement estimator

- This tool gives you an estimated amount based on your actual earnings record.

- Quick calculator

- High-level overview and benefit projections.

- Retirement age calculator

- Find your full retirement age to help with planning your retirement!

There are several other useful tools available to you when you set up your “my Social Security” account.

When it comes to your retirement benefits, certain is always better than pretty sure. Take some time to calculate your projected Social Security benefits to see how that will impact your retirement income plan.

If you’d like to talk with our team about how your Social Security benefit fits into your plan, give us a call.