Consider this scenario: you’re turning 62 years old next year and have the option to take Social Security benefits and retire early. While the idea of retirement is tempting, taking early benefits could cost you more than $700 per month for the rest of your life.

Without proper planning and a clear set of financial goals, making the most effective decision would not only be overwhelming but risky. Do you miss out on Social Security income and continue to work or do you sign the dotted line and hope that you’ll have enough savings to live comfortably?

While Social Security is a financial resource, when you claim is not strictly about dollars and cents. If you keep working, will you miss out on precious family time that you won’t “get back”? Will your health hold out so you can enjoy life after retiring at seventy?

Even though it’s easy to see the glass half empty for both options, having a full understanding of Social Security can get you on the right track. By explaining how Social Security works, providing you with tools to help you plan ahead, and detailing how to apply for benefits, we hope to offer you a sense of reassurance so that you can be prepared when the time comes to retire.

Click here to schedule a complementary Social Security review today

Social Security 101

The Social Security program was created in 1935 as a social welfare and social insurance scheme that supplements other forms of retirement savings, such as 401(k)s or IRAs. During your working life, Social Security taxes are automatically deducted from each paycheck and you receive credits based on the amount that you earn. Typically you can start to withdraw benefits once you reach retirement age, but the amount depends on a variety of different factors.

Social Security credits are the building blocks of the entire system since they’re used to qualify you for benefits. While you’re working and paying Social Security payroll taxes, you can earn up to four credits each year. The amount of earnings that you need to earn a credit has changed over time. In 2018, each $1,320 in covered earnings generated one Social Security or Medicare work credit, but no more than four credits per year.

As of 2018, payroll taxes stood at 12.4 percent on earned income up to $128,700. Employees are typically responsible for 6.2 percent and employers pick up the other 6.2 percent. Any income beyond $128,700 is exempt from Social Security taxes. Social Security is also funded through the taxation of benefits that retirees receive, as well as interest earned on its roughly $2.89 trillion in asset reserves held in the Social Security Trust Fund.

Social Security is often characterized as a retirement program, since about 70 percent of its beneficiaries are retired workers or their spouses and children, but it also provides survivor and disability benefits. The benefits received are based on the individual’s earning history – measured using credits – and cost of living adjustments applied to the initial benefits to reflect annual growth in consumer prices, or inflation.

According to the Congressional Budget Office, Social Security spending is projected to increase from about four percent of gross domestic product in the 1970s to over six percent of GDP by 2038. These dynamics have led to some concerns about the program’s long-term sustainability without reform. Since it’s funded by working Americans, the program can never go bankrupt, but benefits may be cut in the future to make the program more sustainable.

Planning for Social Security

Who Can Claim Social Security?

The simple answer is that individuals aged 62 or older are generally eligible for Social Security benefits so long as they worked for at least ten years to earn the mandatory 40 credits.

Spouses and ex-spouses may also be eligible for spousal benefits that are worth half of their spouse’s full retirement age benefit. Current spouses cannot apply for these benefits until their spouse files for their own benefits, but ex-spouses can receive a spousal benefit even if their ex-spouse has not filed for his or her own benefit. One thing to keep in mind is that the ex-spouse must be aged 62 or older and you must not have remarried until age 60.

Widowed spouses are entitled to 100 percent of their deceased spouse’s benefit at full retirement. You have the option to take reduced benefits as early as age 60, and if you’re disabled, can begin taking benefits at age 50. You can even begin taking benefits on your own earnings record and switch to survivor’s benefits later on, or vice versa, depending on what makes the most financial sense when planning for your future.

How Much Will I Receive?

Social Security benefit amounts are computed by looking at your work history, adjusting it by the Average Wage Index to account for inflation, averaging the highest 35 years of indexed earnings, and calculating the benefit based on that amount. Instead of trying to wrap your head around the complexities of the equation, you should use the online calculator provided by the Social Security Administration.

If you’re looking for a ballpark figure, the average monthly Social Security payment made this year was $1,404 or an annual income of $16,848. In other words, most people won’t be able to rely on these payments to sustain them during retirement, particularly with rising out-of-pocket health care costs. The Social Security program was only designed to provide about 40 percent of the income needed for a comfortable retirement for most people.

When to Claim Social Security

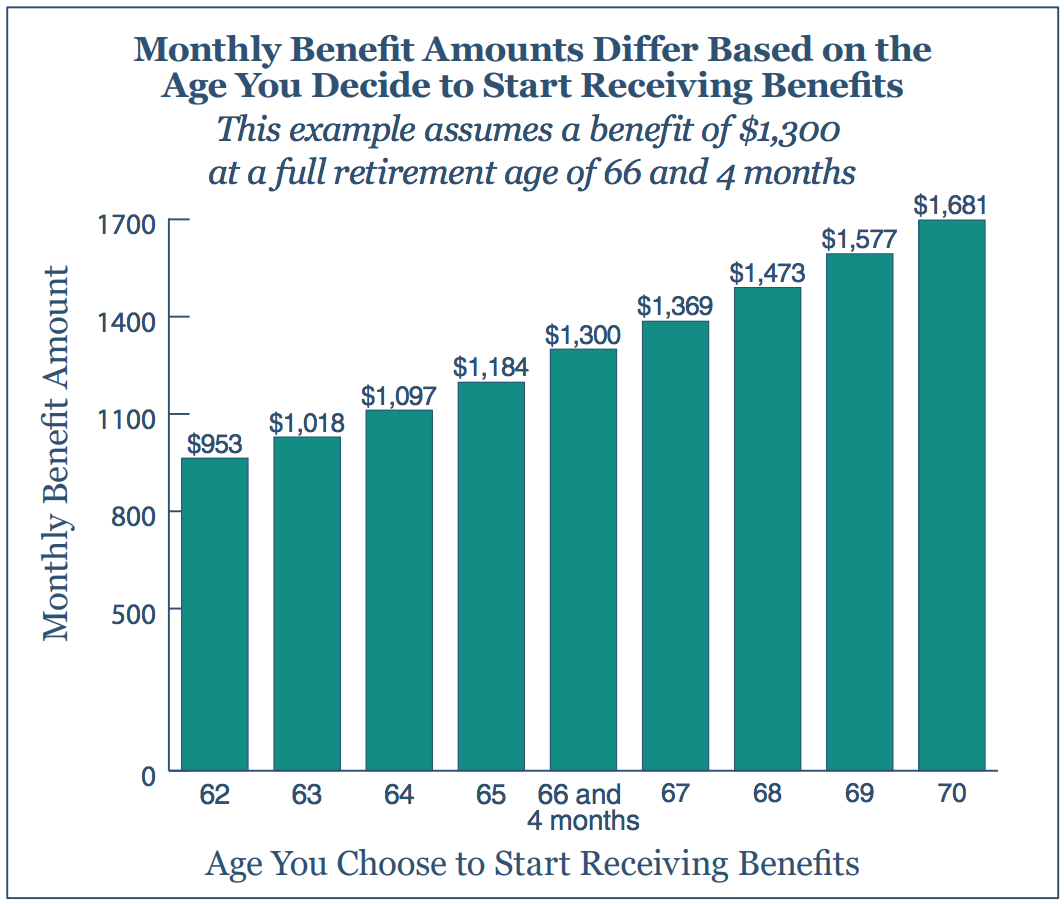

Financially, the best decision is to delay collecting Social Security benefits until the age of 70 since you will maximize your benefit amount. If you are entitled to $1,320 per month at full retirement age, you could collect as little as $953 per month by taking early distributions at age 62 or as much as $1,681 per month by delaying distributions until age 70, according to the SSA. The difference of $728 per month is often a permanent decrease for the rest of your life.

The optimal financial decision is to delay collecting Social Security benefits until 70 to maximize the benefit amount.

Of course, life isn’t always that simple. You may opt to take Social Security distributions before age 70 if you plan on retiring at age 65 and need the cash to finance part of your retirement. On the other hand, if you have a shorter life expectancy due to an illness or medical condition, it might make the most sense to start social security at age 62 since you will still end up with a greater lifetime income than taking larger distributions eight years later.

The decision can also be impacted by your spouse. For example, a higher earning spouse may want to delay their retirement benefits to maximize the percentage-based increases, while the lower earning spouse can file for benefits at full retirement age. This decision may be especially wise since married couples aged 65 today would typically have at least a 50/50 chance that one member would live well beyond the age of 90.

Applying for Social Security

The process of applying for Social Security is fairly easy and can be accomplished online, by phone, or in-person at a local Social Security office. Those living outside of the United States can contact their nearest U.S. Social Security office, Embassy, or consulate to start the application process if desired.

Because no two individuals are the same, there isn’t a magical age to start applying. With that in mind, it may be a good idea to speak with a financial advisor to explain your current situation and receive personable answers to your questions.

Financial advisors can also help when planning ahead for retirement expenses to ensure that you’ll have enough to cover your lifestyle after you’re done working.

Want to talk about your Social Security plan? Sign up for a complementary Social Security review today!