My wife and I have two children under the age of three. As you can imagine, money is at the front of our minds pretty regularly. I looked up the estimated cost of raising a child from birth to age 18 the other day and, I must say, I think I felt a few hairs fall out of my head when I saw the number.

Of course there’s no way to say for sure, but NerdWallet puts the cost of raising children somewhere between $260,000 and $745,000 when you factor in food, housing, clothing, transportation, health care, health insurance, life insurance, child care, cost savings, activities, family vacations, and other costs. If a child has health issues, these costs can quickly rise a lot higher, which makes these expenses extremely important to consider from a financial planning standpoint.

And that’s just for one child.

At TFS, we’re firm believers in the power of a plan, and you’ll definitely want one before you take on the expensive endeavor of raising any number of children.

There are several areas to consider.

Child Care & College Savings

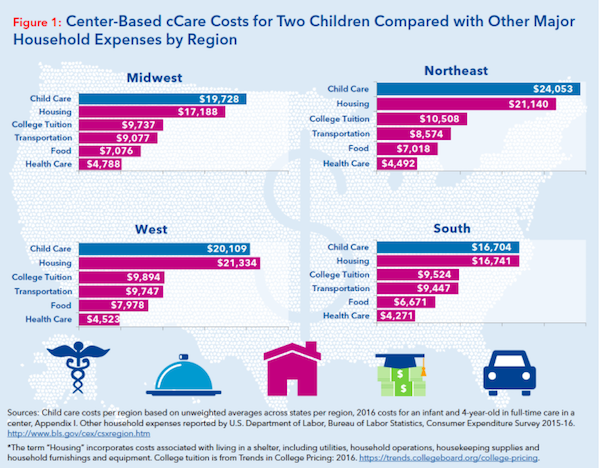

Child care is one of the most expensive aspects of having children. Depending on where you live, it can cost as much or more than college!

The average cost of center-based child care across all states runs between $8,600 and $8,700 per year, exceeding 27 percent of the median income for single parents. Here in Snohomish County, it runs around $850 per month (over $10,000 a year). The statewide average in Washington is over $13,000. If that sounds like a lot, just be glad you don’t live in Massachusetts, where a year of daycare for one child averages more than $20,000.

And let’s not even start on nannies. They can cost up to $35,000 per year.

As a new parent, you might not even be thinking about the cost of college, but now is the best time to work it into your financial plans. If you have two children and you want to have $108,000 saved by the time they turn 18, you’ll need to start saving $250 per month from the time of their birth.

Giving them $54,000 each will probably only cover their first year or so, depending on where they go. If you want to cover most of their college expenses, you’ll probably want to double that amount and start saving $500 a month, or $6,000 per year. If you delay saving a couple years, that number goes up.

We recommend not just setting aside money for your children’s future, but investing that money so it compounds. If you invest that money, you can probably assume an earnings rate of 6%, which would turn that $54,000 each into $98,000 each. With the advantages of compounding returns, the earlier you start saving, the longer your money will have to grow.

Disabilities

The Center for Disease Control estimates that about one in six children between the ages of three and 17 have one or more physical, learning, language, or behavioral disability. Some of these impact day-to-day functioning more than others, and can cost considerably more to manage.

According to a 2004 Morbidity and Mortality Weekly Report, the average lifetime costs associated with severe medical conditions range from roughly $400,000 for hearing loss, up to over $1 million for severe intellectual disabilities. In these cases, it’s important to consider the impact of your own retirement, disability or death on their adult children.

The good news is that there are several government programs in place to help cover these costs. For example, the Childhood Disability Benefit (CDB) and Disabled Adult Child (DAC) programs provide monthly cash payments based on your Social Security earnings. Medicaid and Supplemental Social Security Income (SSI) are two other options for younger children with disabilities.

Insurance Considerations

Health and life insurance are some of the largest expenses incurred by parents, especially if coverage isn’t provided by an employer.

The average family premium (without subsidies) rose 23 percent in 2017 to $1,021, with a deductible that increased five percent to $8,352, and that’s not even accounting for the max out of pocket cost. Employer benefit costs are expected to rise 5.5 percent this year, which translates to higher cost-sharing among employees with health coverage through their employers. Healthcare inflation has fallen considerably since it was over 11 percent in 2007, but the rate remains at about 6.5 percent.

If you don’t have life insurance, becoming a new parent is a great time to give it careful consideration. If you or your spouse passed away, the remaining spouse could have to care for the children and cover greater expenses on their own.

Consider how many dependents you have, how much income would need to be replaced, how much debt you have, and anything that you’d like to leave to your heirs apart from covering the costs. These costs can be substantial on a monthly basis depending on your level of income and specific needs.

Every situation is different, so it’s important to have a plan in place. Once you have a plan in place, you’ll have a better idea of how life insurance fits into it. It is important to talk with your insurance professional (or we could have this discussion with you, too), because most people find it easy to figure out how much they will need to pay off debt but forget to account for the loss of income and future earnings.

Estate Planning

Estate planning is often neglected by new parents, but it’s increasingly important as your family and financial life become more complex. By having a will or trust in place, you can ensure that your young children will be properly cared for if you were to pass away. Estate planning mistakes can prove very costly, especially in complex estates.

The three biggest questions that must be answered by new parents are:

- Who will take care of my children if I pass away? Deciding on a guardian can be a tough process, and even when a guardian is appointed, they must go to the court and apply to become a legal guardian. It’s important to have a conversation with potential guardians and put a formal will in place to make it official.

- How much should my children inherit? You must decide whether to leave children a lump sum, set up an incentive or testamentary trust, or pursue other options. It’s also important to update your will regularly. The trustee is not necessarily always the guardian, so it’s important to discuss who you might want to fill that role for your trust.

- How do I prepare my children to inherit wealth? You should teach your children about finances and walk them through the estate plan when they’re old enough.

It’s usually a good idea to work with an attorney or financial advisor when creating an estate plan. The plan will generally include a will, health care proxy, durable power of attorney, and other documents.

You may also want to consider shifting assets to minimize taxes and maximize what you leave behind. Federal taxes on gifts and estates are among the highest of any financial transaction, which makes planning very important.

The Bottom Line

New parents have a lot on their plate, but they shouldn’t sweat the details. By planning ahead for expenses, saving for college expenses, and ensuring an estate is in order, you can minimize your monthly cash outlay, maximize your children’s college funds, and ensure that everyone gets what they need when you pass away.

Want to talk about planning your finances for children? Drop us a line!